The cryptocurrency market is currently marked by notable volatility, with major assets experiencing significant price fluctuations. Regulatory developments are increasingly shaping investor behavior and market dynamics across various jurisdictions. As compliance becomes a focal point, the balance between consumer protection and innovation remains delicate. Emerging technologies stand poised to redefine transaction efficiency and accessibility. However, the true impact of these shifts on investor sentiment and market stability is yet to unfold.

Recent Price Fluctuations in Major Cryptocurrencies

As the cryptocurrency market continues to evolve, recent price fluctuations in major cryptocurrencies have captured the attention of investors and analysts alike.

Market volatility has intensified, leading to varied price predictions across platforms. This unpredictability reflects both investor sentiment and external factors influencing the market.

Consequently, traders must remain vigilant, adapting strategies to navigate the shifting landscape and capitalize on potential opportunities.

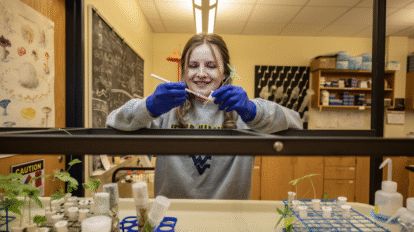

See also: Latest News in Science: Exciting Research Updates

Emerging Technologies Shaping the Future of Crypto

Recent price fluctuations in major cryptocurrencies underscore the need for innovative solutions within the market.

Emerging technologies, particularly those enhancing blockchain scalability, are poised to revolutionize decentralized finance. These advancements aim to increase transaction throughput and reduce costs, fostering greater accessibility and efficiency.

As the ecosystem evolves, they promise to empower users with more freedom and control over their financial assets.

Regulatory Developments Across Key Jurisdictions

While the cryptocurrency landscape continues to evolve, regulatory frameworks across key jurisdictions are rapidly adapting to address the unique challenges posed by digital assets.

Regulatory compliance remains a focal point, as authorities grapple with jurisdictional challenges that impact enforcement and innovation.

Countries are increasingly harmonizing regulations to foster a balanced approach, aiming to protect consumers while encouraging the growth of a decentralized financial ecosystem.

Impact of Market Trends on Investor Sentiment

A significant correlation exists between market trends and investor sentiment in the cryptocurrency sector.

Market psychology plays a crucial role, as fluctuations can significantly alter investor behavior. Positive trends often lead to increased optimism and engagement, while downturns may incite fear and hesitation.

Understanding these dynamics is essential for navigating the volatile landscape, allowing investors to make informed decisions aligned with their aspirations for financial freedom.

Conclusion

In conclusion, the cryptocurrency market’s current volatility underscores the age-old adage, “What goes up must come down.” As price fluctuations continue to reflect investor sentiment and regulatory shifts, the integration of emerging technologies may offer pathways for enhanced transaction efficiency and stability. Navigating these turbulent waters demands adaptability from traders, who must balance risk with opportunity in a rapidly evolving landscape. The interplay of innovation and regulation will be pivotal in shaping the future of decentralized finance.